What is a Mutual Fund?

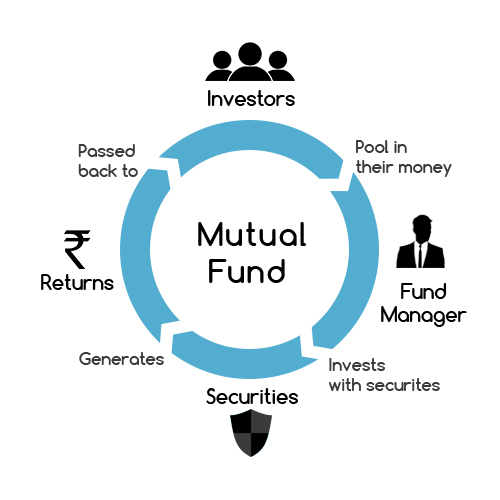

A mutual fund is a type of investment vehicle that pools money from multiple investors to purchase a portfolio of securities such as stocks, bonds, and other assets. The fund is managed by a professional fund manager who invests the money in a diversified portfolio of assets, on behalf of the investors.

How Does a Mutual Fund Work?

When you invest in a mutual fund, you are buying units of the fund, which represent a portion of the overall fund's holdings. The value of these units fluctuates based on the performance of the underlying assets.

Mutual funds can be actively or passively managed. Active mutual funds have fund managers who make decisions about which assets to purchase and when to sell them. Passive mutual funds, on the other hand, track a market index, such as the S&P 500, and seek to replicate its performance.

What are the Types of Mutual Funds?

There are many different types of mutual funds, each with its own investment objective. Here are some of the most common types:

Equity Funds

Equity funds, also known as stock funds, invest primarily in stocks of publicly traded companies. They can be further classified as large-cap, mid-cap, or small-cap funds, depending on the size of the companies they invest in.

Fixed Income Funds

Fixed-income funds invest in bonds and other debt securities. These funds aim to provide a steady stream of income to investors while minimizing the risk of default.

Balanced Funds

Balanced funds, also known as hybrid funds, invest in a combination of stocks and bonds. They aim to provide both capital appreciation and income to investors while balancing risk and return.

Money Market Funds

Money market funds invest in short-term, low-risk securities such as government bonds, certificates of deposit, and commercial paper. They aim to provide a high level of liquidity and safety to investors.

Specialty Funds

Specialty funds invest in specific sectors or themes, such as real estate, technology, or socially responsible investing. These funds can be riskier than other types of mutual funds, but they also offer the potential for higher returns.

How to Invest in a Mutual Fund?

There are several ways to invest in mutual funds:

through a financial advisor

Many investors choose to invest in mutual funds through a financial advisor, who can offer personalized advice and guidance on which funds to invest in.

through a brokerage account

Investors can also invest in mutual funds through a brokerage account, such as a traditional IRA or a Roth IRA.

through a workplace retirement plan

If your employer offers a 401(k) or other workplace retirement plan, you may be able to invest in mutual funds through that plan.

What are the Advantages of Mutual Funds?

Here are some of the advantages of investing in mutual funds:

Diversification: By investing in a mutual fund, you can gain exposure to a diversified portfolio of assets, which can help to reduce your investment risk.

Professional management: Mutual funds are managed by professional fund managers who have the expertise and resources to make informed investment decisions on your behalf.

Liquidity: Mutual funds are generally highly liquid, meaning that you can buy and sell them easily.

Convenience: Mutual funds are easy to invest in and can be purchased through a variety of channels.

What are the Risks of Mutual Funds?

Here are some of the risks of investing in mutual funds:

Market risk: The value of your mutual fund can fluctuate based on the performance of the underlying assets.

Management risk: The performance of your mutual fund can be affected by the decisions of the fund manager.

Fees: Mutual funds can come with fees and expenses, which can eat into your returns.

Mutual funds have become an increasingly popular investment option for people looking to grow their wealth. They offer a diversified portfolio of stocks, bonds, and other securities, making them a great option for those who want to invest but don't have the time or expertise to manage their own portfolio. In this article, we'll take a look at what mutual funds are, how they work, the different types of mutual funds, and how to invest in them.

What are mutual funds?

Mutual funds are investment vehicles that pool money from multiple investors to purchase a portfolio of securities. These securities can include stocks, bonds, and other assets. The portfolio is managed by a professional fund manager who makes investment decisions based on the fund's investment objectives.

How do mutual funds work?

When you invest in a mutual fund, you are buying shares in the fund. The value of the shares you own is based on the net asset value (NAV) of the fund. The NAV is calculated by dividing the total value of the fund's assets by the number of shares outstanding. As the value of the fund's assets increases, so does the NAV. When you sell your shares, you receive the NAV price at the time of sale.

Different types of mutual funds

There are many different types of mutual funds, each with its own investment objective. Some common types of mutual funds include:

- Equity funds: These funds invest primarily in stocks. They can be further classified into different categories based on the size of the companies they invest in (large-cap, mid-cap, small-cap), the sector they invest in (technology, healthcare, energy), or the investment style (value, growth).

- Fixed-income funds: These funds invest primarily in bonds and other fixed-income securities. They can be further classified into different categories based on the type of bonds they invest in (government, corporate, municipal), the credit quality of the bonds (investment-grade, high-yield), or the duration of the bonds (short-term, intermediate-term, long-term).

- Balanced funds: These funds invest in a mix of stocks and bonds. They can be further classified into different categories based on the allocation between stocks and bonds.

- Index funds: These funds track a specific index, such as the S&P 500 or the Dow Jones Industrial Average. They aim to replicate the performance of the index they track.

- Specialty funds: These funds invest in specific sectors, such as real estate or natural resources.

How to invest in mutual funds

Investing in mutual funds is easy and can be done in a few simple steps:

Determine your investment objectives: Before investing in a mutual fund, it's important to determine your investment objectives and risk tolerance. This will help you choose the right type of mutual fund that aligns with your goals.

Choose a fund: Once you have determined your investment objectives, you can choose a mutual fund that meets your needs. You can research different mutual funds online or consult with a financial advisor.

Open an account: To invest in a mutual fund, you need to open a brokerage account. This can be done through an online brokerage or a traditional brokerage firm.

Invest: Once you have opened an account, you can invest in the mutual fund by buying shares. You can choose to invest a lump sum or set up automatic investments through a systematic investment plan (SIP).

How to earn profit from mutual funds

There are two ways to earn profit from mutual funds:

Capital appreciation: When the value of the fund's assets increases, the NAV of the fund also increases, resulting in capital appreciation. If you sell your shares when the NAV is higher than the price at which you bought them, you can earn a profit.

Dividends: Mutual funds can also distribute dividends to investors. These dividends can be reinvested in the fund or taken as income.

Risks and advantages of investing in mutual funds

As with any investment, there are risks and advantages to investing in mutual funds. Some advantages of investing in mutual funds include:

- Diversification: Mutual funds offer a diversified portfolio of securities, reducing the risk of investing in a single stock or bond.

- Professional management: Mutual funds are managed by professional fund managers who have the expertise to make investment decisions.

- Liquidity: Mutual funds can be bought and sold easily, making them a liquid investment option.

Some risks of investing in mutual funds include:

- Market risk: Mutual funds are subject to market fluctuations, which can result in a loss of principal.

- Fees: Mutual funds charge fees for management and other expenses, which can reduce returns.

- Lack of control: Investors have no control over the day-to-day management of the fund.

Platforms for investing in mutual funds

There are many platforms available for investing in mutual funds, including:

- Online brokerages: Online brokerages such as Robinhood, E-Trade, and TD Ameritrade offer easy access to mutual funds.

- Traditional brokerages: Traditional brokerages such as Charles Schwab and Fidelity offer a range of mutual funds to choose from.

- Robo-advisors: Robo-advisors such as Betterment and Wealthfront offer automated investment management and access to a range of mutual funds.

Conclusion

Mutual funds are a great investment option for people looking to grow their wealth. They offer a diversified portfolio of securities, professional management, and liquidity. However, investors should be aware of the risks and fees associated with investing in mutual funds and should do their research before choosing a fund. By following the steps outlined in this article, investors can start investing in mutual funds and working towards their investment goals.

How To Invest in Mutual Funds

The Benefits of Investing in Mutual Funds: A Win-Win Strategy

Investing in mutual funds offers several benefits to investors, such as diversification, professional management, and liquidity. Mutual funds invest in a diversified portfolio of securities, which helps to reduce the risk of losses. Professional fund managers manage mutual funds, which eliminates the need for investors to research and select individual securities. Mutual funds are also highly liquid, which means that investors can easily buy and sell their shares.

Types of Mutual Funds: Exploring the Investment Landscape

There are several types of mutual funds available, such as equity funds, debt funds, index funds, and sector funds. Equity funds invest mainly in stocks, whereas debt funds invest in fixed-income securities like bonds. Index funds track a specific index, while sector funds focus on a particular industry or sector. Investors can choose the type of mutual fund that aligns with their investment goals and risk tolerance.

Mutual Fund Basics: Understanding the Fund Structure and Operations

Mutual funds are structured in a way that allows investors to pool their money into a fund managed by a professional fund manager. The fund manager invests the pooled money into a diversified portfolio of securities. Mutual funds are regulated by the Securities and Exchange Board of India (SEBI) and must adhere to strict regulations.

Key Factors to Consider Before Investing in Mutual Funds

Before investing in mutual funds, investors must consider several key factors, such as their investment goals, risk tolerance, investment horizon, and fees. Investors should also consider the fund's historical performance, the fund manager's track record, and the fund's expense ratio.

Risk and Return: Analyzing Performance Metrics in Mutual Funds

Mutual funds are subject to market risk. Investors must analyze the fund's historical performance metrics such as Standard Deviation, Sharpe Ratio, Beta, Alpha, and Sortino Ratio to assess the fund's risk and return potential.

Diversification: Spreading Your Investments for Stability and Growth

Diversification is a crucial strategy for mutual fund investing. Investors can diversify their portfolios by investing in a mix of mutual funds across various asset classes and sectors.

Active vs. Passive Management: Which Mutual Fund Approach Is Right for You?

Active management involves a fund manager making investment decisions to outperform the market. Passive management involves tracking an index or market. Investors must select the right approach based on their investment goals and risk tolerance.

SIPs (Systematic Investment Plans): A Disciplined Approach to Wealth Creation

SIPs are a convenient way to invest in mutual funds regularly. SIPs allow investors to invest a fixed amount of money at regular intervals, which helps to average out the cost of investments.

ELSS (Equity-Linked Saving Schemes): Tax-Efficient Investment Options

ELSS is a tax-saving mutual fund that invests mainly in equity securities. ELSS offers a tax benefit under Section 80C of the Income Tax Act, which makes it an attractive option for investors.

Asset Allocation: Balancing Risk and Reward in Mutual Fund Investing

Asset allocation involves dividing your investment portfolio into different asset classes like equity, debt, and gold. Asset allocation helps to balance the risk and reward potential of your investments.

Sector Funds: Tapping into Specific Industry Opportunities

Sector funds focus on a specific industry or sector, such as technology, healthcare, or energy. Sector funds offer investors an opportunity to invest in a particular industry or sector that they believe will perform well.

Debt Funds: Generating Steady Income with Fixed-Income Investments

Debt funds invest in fixed-income securities like bonds and offer steady income to investors. Debt funds are an attractive option for investors who want to generate a regular stream of income.

Index Funds: Capturing Market Performance at a Low Cost

Index funds track a specific index and offer investors an opportunity to capture market performance at a low cost. Index funds are a popular option for investors who want to invest in the stock market passively.

Value Investing: Identifying Undervalued Mutual Funds

Value investing involves identifying undervalued mutual funds that are trading below their intrinsic value. Value investing is a popular investment strategy among investors who want to invest in mutual funds that have the potential for long-term growth.

Growth Investing: Navigating High-Potential Opportunities

Growth investing involves investing in mutual funds that have the potential for high growth. Growth investing is a popular investment strategy among investors who are willing to take on high-risk investments.

Analyzing Market Trends: How to Stay Informed as a Mutual Fund Investor

Investors must stay informed about the market trends and economic indicators that affect mutual fund performance. Investors can stay informed by reading financial news, attending investment seminars, and consulting with a financial advisor.

Top Mutual Funds to Watch: Exploring Promising Performers

Investors can explore promising mutual funds by analyzing their historical performance, fund manager track record, and expense ratio. Investors can also consult with a financial advisor to identify mutual funds that align with their investment goals.

Navigating Market Volatility: Tips for Surviving Turbulent Times

Investors must be prepared to navigate market volatility and downturns. Investors can navigate market volatility by diversifying their portfolio, investing for the long term, and avoiding emotional investment decisions.

Environmental, Social, and Governance (ESG) Investing: The Rise of Responsible Mutual Funds

ESG investing involves investing in mutual funds that focus on environmental, social, and governance factors. ESG investing is a popular investment strategy among investors who want to invest in companies that are socially responsible.

Investment Strategies for Different Life Stages: Young Professionals to Retirees

Investors must consider their life stage and investment goals when selecting investment strategies. Young professionals may want to focus on growth investing, whereas retirees may want to focus on income-generating investments.

How to Build a Mutual Fund Portfolio: A Step-by-Step Guide

Investors can build a mutual fund portfolio by selecting mutual funds that align with their investment goals, diversifying across asset classes and sectors, and monitoring their portfolio regularly.

Evaluating Mutual Fund Performance: Key Metrics and Tools

Investors can evaluate mutual fund performance by analyzing key metrics like returns, expense ratio, and risk metrics. Investors can also use online tools like mutual fund screeners to evaluate mutual funds.

Calculating Mutual Fund Costs: Understanding Expense Ratios and Fees

Investors must be aware of the costs associated with investing in mutual funds, such as expense ratios and other fees. Investors can calculate mutual fund costs using online calculators or consulting with a financial advisor.

Rebalancing Your Portfolio: Ensuring Alignment with Your Financial Goals

Investors must rebalance their portfolio regularly to ensure alignment with their financial goals. Rebalancing involves selling and buying mutual funds to maintain the desired asset allocation.

Taking the Plunge: Getting Started with Mutual Fund Investments

Investors can get started with mutual fund investments by identifying their investment goals, risk tolerance, and investment horizon. Investors can then select a mutual fund company or broker, open an investment account, and choose a mutual fund to invest in.

The Future of Mutual Funds: Innovations and Trends to Watch

The mutual fund industry is constantly evolving, and investors must stay informed about the latest innovations and trends. Some of the trends to watch include robo-advisors, alternative investments, and ESG investing.

Fine-Tuning Your Financial Future: Leveraging Mutual Funds for Success

Mutual funds offer investors a convenient way to access a diverse range of investment opportunities. By selecting mutual funds that align with their investment goals and risk tolerance, investors can fine-tune their financial future and achieve long-term success.

Conclusion

Mutual funds are a popular investment vehicle for many investors, offering diversification, professional management, liquidity, and convenience. However, they also come with risks and fees that investors should be aware of. If you're considering investing in mutual funds, it's important to do your research and choose funds that align with your investment objectives and risk tolerance.